Swing exchanging is a style of exchanging that holds an open position(s) in any event overnight and up to a few days or even a little while. It can consolidate both the specialized examination part of day exchanging and the major research part of contributing.

Swing exchanging still includes dynamic position administration yet uses longer time interims to decide value targets and stop-misfortune levels. Many lean toward swing exchanging as the more extensive time periods tend smooth out here and now “commotion” bringing about a more quiet experience contrasted with the excited pace of day exchanging.

Swing Trading Vs. Day Trading

Day Trading

As the name expresses, it’s “day” exchanging which restrains the exchanging movement to a solitary day by day exchanging session. The United States values showcases authoritatively open for exchanging at 9:30 am EST (Eastern Standard Time) and shut down at 4:00 pm EST each Monday through Friday. Day exchanging is a style of exchanging that looks to benefit from purchasing and offering stocks (or any tradeable monetary instrument) intra-day and finishes off all positions previously the market close. This style doesn’t bring about overnight hazard since everything is finished off to money before the day’s over.

Pre-showcase exchanging can begin as right on time at 4:00 am EST. through ECNs (electronic interchanges systems) and shut down at 8:00 pm EST. Check with your particular online dealer to affirm get to data.

Similitudes Between Day Trading and Swing Trading

Day exchanging and swing exchanging share numerous similitudes. Truth be told, swing exchanging can nearly be viewed as a type of day exchanging that is performed on a substantially bigger time period. A similar kind of exchange administration and example set-ups are used, yet with more extensive value ranges.

Looks To Profit From Near-Term Price Action Versus Buy and Hold Investing

Both day exchanging and swing exchanging look to benefit from moderately shorter/close term value activity contrasted with a purchase and hold venture system. Long haul speculations might be held for a considerable length of time in a uninvolved limit. Day exchanging included the most dynamic administration from moment to minute. Swing exchanging still requires checking relying upon the holding time, yet can extend from hourly to day by day.

Example Set-Up Based Trades

Both day exchanging and swing exchanging spin around playing diagram design set-ups utilizing specialized investigation. Day exchanging centers around the shorter time period form of a specific example, while swing exchanging centers around the more extended time allotment adaptation of the example. By utilizing a blend of pointers and example set-ups, the two sorts of merchants try to enter and leaves positions for a benefit, while overseeing danger and reward.

Can play the two sides of the market

Both day exchanging and swing exchanging can play long or short positions. While any presentation in the market either long or short can hold up under hazard, a short position tends to convey significantly more potential hazard because of the likelihood of a short-crush. Overnight and swing short positions must be checked all the more painstakingly since these require the utilization of edge to obtain shares. The capability of misfortune is in fact boundless.

Contrasts Between Day Trading and Swing Trading

Time allotment

Swing exchanging includes a more drawn out holding period because of using more extensive time allotment outlines. The diagramming time allotment interims regularly utilized for swing exchanging are 15-minutes, 30-minutes, a hour, day by day and week after week. Brokers searching for more exact section and leaves will move to the 1-moment and 5-minute graphs for exchange executions.

Overnight Event Risk

The exacting recognizing distinction between day exchanging and swing exchanging is the overnight occasion chance factor. Day exchanging takes no overnight positions, while swing exchanging includes taking overnight position(s) that can traverse up to a little while. Informal investors trust that the wild and flighty nature of an overnight occasion is excessively hazard to hold up under, particularly since they have no entrance to diminishing the hazard in the small hours of the morning before the market opens. Overnight occasion hazard can be as normal as a hole down in the S&P 500 fates to an unexpected sudden income cautioning, which can spell calamity for a long position.

Less Monitoring/Efficiency/Less Time Constraints

Swing exchanging requires less very close checking contrasted with day exchanging, where seconds to minutes matter the most. This makes swing exchanging more advantageous for dealers who have all day employments or restricted market access amid the exchanging day. Brokers who have a more uninvolved disposition or get squirmed excessively with shorter time spans have a tendency to lean toward swing exchanging.

Less Trading Activity

Swing exchanging costs less in commissions because of the littler recurrence of exchanges contrasted with day exchanging. Swing exchanges may add up to only a couple of merchants for each week contrasted with the tens to many exchanges that a dynamic day exchanging may execute.

Swing Trading Under PDT Rules

Brokers that don’t meet the base $25,000 adjust under PDT (Pattern Day Trader) guidelines may consider swing exchanging since overnight positions don’t qualify as intraday roundtrips. The PDT run limits dealers to three intraday roundtrips if the adjust is under $25,000. Swing exchanges sidestep this stipulation since all positions are held at least one overnight.

Bigger Price Moves

Swing brokers can exploit bigger value moves (i.e. multi-day sprinters) that may focus on a few focuses contrasted with informal investors that may target just 10 to 30 penny scalps. Be that as it may, the bigger value swings cuts both ways. Bigger stop misfortunes are additionally utilized with swing exchanges. To counterbalance this instability hazard, swing exchanges tend to hold littler measured positions (ie: 300-500 offers) contrasted with day exchanges that can augment the utilization of use (ie: 1000-5000 offers) by focusing on little holding periods that may last from seconds to minutes.

Apparatuses of the Trade

Regardless of whether day exchanging or swing exchanging, there are sure essential instruments of the exchange that you will require with a specific end goal to give yourself the most obvious opportunity at progress.

Specialized Analysis

This is the style of research that lone concentrates on the stock’s value activity, not the business operations. The stock’s value history is examined on an outline to recognize and foresee normally repeating value designs. Brokers endeavor to catch benefits by putting exchanges

Diagrams

The most fundamental apparatus of specialized examination is a value diagram. There are many kinds of diagrams including candle, bar and line outlines. The graphs are additionally fragmented into various time interims. Informal investors have a tendency to organize shorter time allotment interims like the 1-minute, 5-moment and 15-minute diagrams, which are best for intraday exchanging. Swing merchants like to utilize bigger time period interims like the hour long, day by day and week by week graphs. The more extensive circumstances outlines take into account smoother value activity.

Diagram Patterns

Diagram designs depend on repeating verifiable value activity. They delineate value breakouts or breakdowns. Breakouts frame when request overpowers supply and makes the value break out of the present value run as it rises higher shaping an uptrend. An uptrend makes higher highs on bobs and higher lows on pullbacks.

[ Further Reading: A Guide to Use Bollinger Bands ]

Breakdowns frame when value falls bring down from the present exchanging reach and keep on falling logically bring down shaping a downtrend. A downtrend makes bring down highs on ricochets and lower lows on offer offs. The strategy in which value frames these breakouts and breakdowns are distinguished and named for future reference and triggers. Regular diagram designs incorporate triangles, head and shoulders, wedges and banners.

Specialized Indicators

Specialized pointers are pre-modified outline devices that measure different components to help the broker in dissecting backing, protection and overbought/oversold perusing to distinguish exchange triggers. Exchange triggers are purchase and offer signs created by the value activity with respect to the particular example.

Cost and Momentum Tools

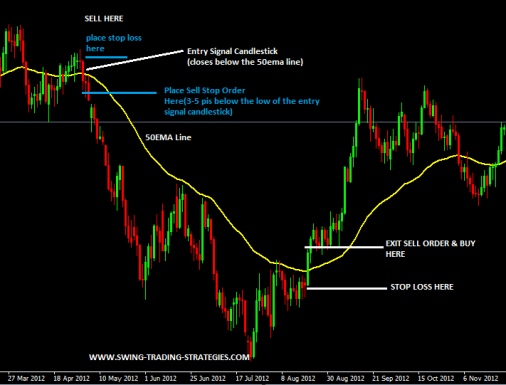

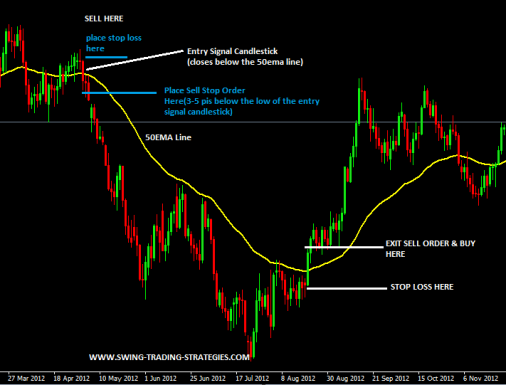

Value apparatuses like moving midpoints and pattern lines help to track the bearing of the fundamental stock. Force devices like stochastic, RSI and MACD help to decide whether the value move is in the beginning times or getting long in the tooth. By consolidating cost and force pointers, merchants can quantify and pinpoint passages and ways out with enhanced accuracy.

Central Analysis: Earnings/News/Press Releases

Central investigation is the exploration of an organization’s operations. Profit reports have a tendency to have the most material effect on stock cost. Both informal investors and swing merchants should focus on central investigation to some degree. Informal investors will profits by realizing what might cause the hidden value hole up or down in a stock.

Swing brokers will give careful consideration to the basics and any important information from the organization since they are most influenced by occasion hazard, particularly overnight. The more drawn out the holding time, the more accentuation is put on the news and key elements since stock costs in the long run reflect how the hidden business is working and how the market trusts it will perform later on.